Warren Buffett’s Principles for Picking Stocks: A Guide to Investment Success

- Giovanni Mendoza

- Apr 9, 2025

- 5 min read

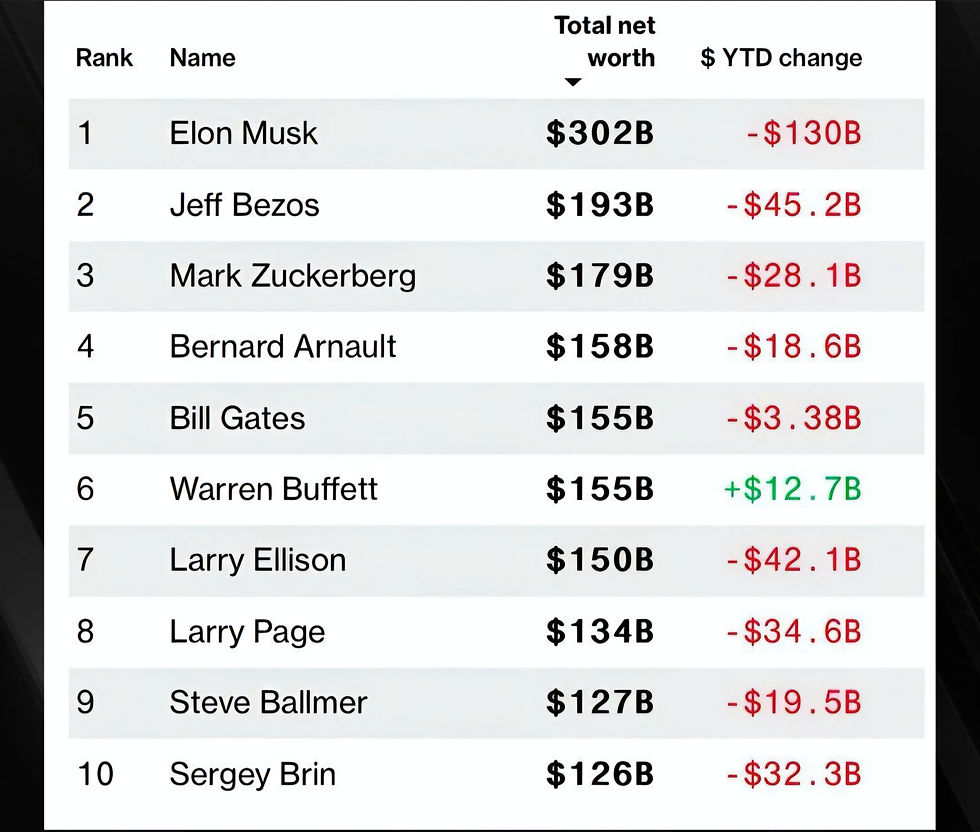

Warren Buffett, often referred to as the "Oracle of Omaha," is one of the most successful investors of all time. Over the course of his career, Buffett has amassed a fortune worth billions, largely through his investment vehicle, Berkshire Hathaway. His success isn’t merely a product of luck, but a result of a deep and methodical approach to stock selection that can be distilled into several key principles. Understanding these principles can help any investor improve their decision-making process and avoid common pitfalls.

1. Invest in What You Understand

Buffett is a firm believer in the "circle of competence." This principle suggests that you should only invest in companies and industries that you understand. He believes that by sticking to what you know, you can better evaluate the risks and opportunities a company faces. For instance, Buffett has famously avoided investing in technology stocks for much of his career because he didn’t feel he fully understood how they operated. Instead, he focused on businesses with predictable and stable earnings, like Coca-Cola, American Express, and Gillette.

Key Takeaway: Don’t invest in a company just because it's trendy or has a lot of hype. Stick to industries and companies you can analyze and evaluate with confidence.

2. Look for a Strong, Consistent Track Record

Buffett values companies that have a strong track record of performance. He is not swayed by short-term market movements but rather looks for businesses that have demonstrated consistent profitability over time. When evaluating a company, he often looks for businesses that have been successful for at least 10 years and ideally have an established market position.

In addition to financial performance, Buffett seeks companies that can weather different economic conditions. This stability is a key characteristic of businesses he believes are worth investing in.

Key Takeaway: Look for businesses with a proven history of success, not just a flash in the pan.

3. Economic Moats Matter

An "economic moat" is a competitive advantage that protects a company from the competition. Buffett emphasizes the importance of this moat in stock selection. Companies with wide moats are better positioned to maintain high-profit margins and fend off competitors. Examples include brand recognition, cost advantages, network effects, and regulatory barriers. For instance, Coca-Cola’s global brand recognition and strong distribution network provide a significant economic moat that makes it harder for competitors to encroach on its market share.

Buffett has often praised companies like Coca-Cola, Johnson & Johnson, and See’s Candies for having these strong economic moats. These companies are able to generate superior returns on capital because their competitive advantages are difficult for others to replicate.

Key Takeaway: Look for companies with a strong competitive advantage that protects them from rivals.

4. Look for Companies with a Strong Management Team

Buffett places a significant amount of emphasis on the quality of a company’s leadership. He seeks out businesses with management teams that are not only talented but also operate with a high level of integrity and transparency. For example, Buffett has often praised the management teams at companies like Geico and Dairy Queen for their ability to operate effectively and ethically.

In evaluating a company, Buffett often looks for signs that the management team is focused on long-term growth, rather than short-term profits. He values managers who reinvest profits into the business, treat shareholders with respect, and act conservatively when it comes to debt.

Key Takeaway: The quality of a company’s management is just as important as its financials. Look for leaders who act in the best interests of shareholders.

5. Focus on Intrinsic Value and Margin of Safety

One of Buffett’s core principles is the idea of intrinsic value—the true, inherent worth of a business. Buffett defines intrinsic value as the present value of a company’s future cash flows, adjusted for the risks involved. When he invests in a company, he looks for stocks that are trading below their intrinsic value, which provides a "margin of safety." This margin protects the investor in case the company’s performance is not as expected.

Buffett emphasizes that buying a stock below its intrinsic value gives investors a cushion, ensuring they won’t lose money even if things don’t go as planned. This approach aligns with his overall philosophy of minimizing risk while maximizing long-term returns.

Key Takeaway: Always calculate the intrinsic value of a business and ensure the stock is trading at a discount to it, providing a margin of safety.

6. Patience is Key

Buffett’s most famous principle is probably his focus on long-term investing. He has always advocated for holding onto stocks for long periods, often decades. The idea is that great businesses will continue to grow and compound wealth over time. Buffett’s investment in companies like Coca-Cola, American Express, and Berkshire Hathaway itself exemplifies his long-term approach.

Buffett often says that his ideal holding period is “forever,” as long as the company continues to perform well and its economic moat remains intact. This patience allows his investments to compound and grow significantly over time.

Key Takeaway: Patience is a critical part of investing. Don’t be swayed by short-term market fluctuations. Hold onto your investments as long as the company’s fundamentals remain strong.

7. Avoid Debt and Leverage

Buffett is a strong advocate for avoiding unnecessary debt. He has often emphasized the risks of using leverage to increase returns, particularly when it comes to investing in businesses. Debt can amplify profits, but it can also exacerbate losses when markets turn sour. Buffett’s own investing strategy typically avoids using debt and focuses on businesses that have low levels of debt relative to their earnings.

By steering clear of high leverage, Buffett reduces the risk of catastrophic losses during periods of economic downturn or volatility.

Key Takeaway: Avoid companies that rely heavily on debt to finance their operations. Look for companies with strong balance sheets and low levels of leverage.

8. Invest in Businesses with Predictable Cash Flows

Buffett favors businesses that generate steady, predictable cash flows. Companies with consistent and reliable cash flow are less susceptible to market volatility and economic downturns. Businesses like utilities, consumer staples, and well-established service providers often fit this mold, as they tend to have reliable revenue streams regardless of economic conditions.

Predictable cash flows allow companies to reinvest in their business, pay dividends, and reward shareholders over time.

Key Takeaway: Favor businesses that produce consistent and predictable cash flows, which will give you more confidence in their ability to weather difficult times.

Warren Buffett’s stock-picking principles are rooted in a deep understanding of business fundamentals, long-term thinking, and a disciplined approach to risk. By focusing on businesses with a strong competitive edge, capable management, and a history of consistent performance, investors can build a portfolio that stands the test of time. These principles are not just the key to Buffett’s success; they are timeless strategies that anyone can apply to improve their investment decision-making.

Comments